In 2025, the cloud is no longer optional-it’s the backbone of modern business. Enterprises are scaling globally, startups are innovating faster than ever, and digital transformation is driving competitive advantage. Yet, there’s a silent problem: cloud waste.[Learn More About Low Cost Cloud Management]

According to Gartner, more than 30% of cloud spend is wasted annually due to idle resources, lack of visibility, and poor governance. Finance leaders are pressuring IT teams to justify every cloud dollar, while CIOs are scrambling to align cloud investments with business value.

Unlike traditional cost-cutting tools, CostQ is strategic, scalable, and intelligence-driven. It empowers FinOps leaders, CFOs, and engineering teams to collaborate, making cloud spending predictable, efficient, and aligned with business outcomes.

What Is Cloud Financial Management (CFM)?

Cloud financial management is the practice of tracking, optimizing, and governing cloud usage and costs across an organization. It is often referred to as FinOps (Financial Operations), emphasizing the collaboration between finance, engineering, and business leaders.

Core Principles of Cloud Financial Management

- Visibility – Break down cloud bills to understand which teams, projects, or applications drive costs.

- Optimization – Identify wasted resources, underutilized services, and opportunities for cost reduction.

- Governance – Set budgets, enforce policies, and ensure compliance.

- Accountability – Drive a culture where teams are responsible for the costs they generate.

- Forecasting & Planning – Predict future spend, align with budgets, and avoid financial shocks.

Unlike traditional IT finance, which deals with fixed CAPEX-based models, cloud financial management addresses the variable, consumption-based nature of the cloud. Every decision—whether scaling up an instance, deploying a new workload, or running analytics—directly impacts cost.

Why Businesses Need Cloud Financial Management in 2025

The multi-cloud reality is here. Most organizations use AWS, Azure, and Google Cloud simultaneously, leading to fragmented cost visibility. At the same time, economic pressures are forcing CFOs to demand proof of ROI on every investment.

Key Challenges Driving the Need for CFM:

- Cloud waste: Gartner reports that 30–40% of spend is wasted on idle or over-provisioned resources.

- Complex billing: Cloud invoices often run into hundreds of pages, with hidden costs and obscure pricing.

- Unpredictable budgets: On-demand scaling can lead to bill shocks.

- Shadow IT: Teams deploy workloads without finance oversight, driving untracked expenses.

- Multi-cloud sprawl: Costs spread across multiple providers make it harder to consolidate.

Without a solution like CostQ, these challenges can erode profitability, hinder innovation, and create friction between finance and technology teams.

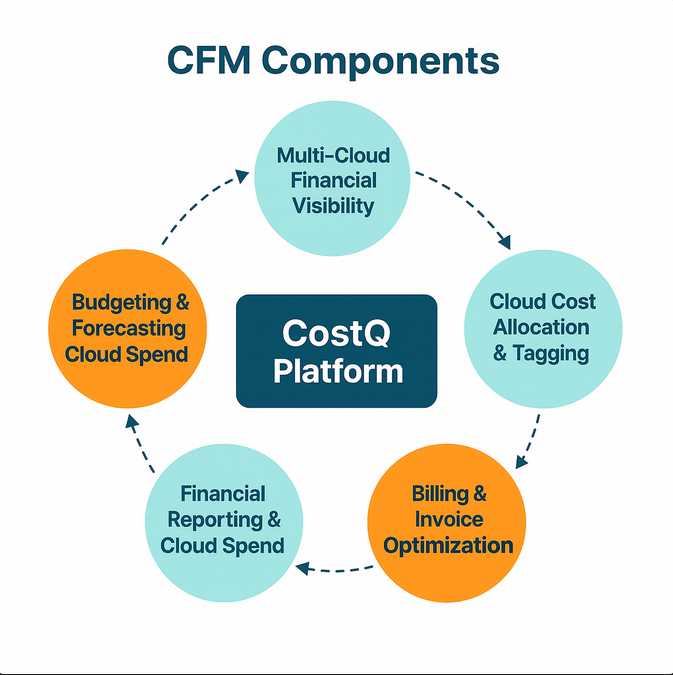

Key Components of Cloud Financial Management (and How CostQ Solves Them)

1. Cost Allocation & Tagging

Cloud bills must be allocated to departments, projects, or customers. CostQ automates tagging, ensuring every resource is properly tracked. This enables chargeback/showback models, where teams are accountable for their spend.

2. Budgeting & Forecasting

Cost forecasting in the cloud is tricky due to variable workloads. CostQ uses AI-powered trend analysis to predict costs with accuracy, helping businesses avoid surprises.

- CFOs can set budgets.

- Engineering teams receive alerts when they’re nearing limits.

- Executives can plan cloud strategy aligned with revenue projections.

3. Billing & Invoice Optimization

Cloud invoices are complex. CostQ simplifies billing by:

- Detecting anomalies (e.g., sudden cost spikes).

- Recommending AWS Reserved Instances, Spot Instances, and Savings Plans.

- Identifying unused services for elimination.

4. Governance & Policy Enforcement

CostQ enforces financial guardrails across the organization. Policies like auto-shutdown for dev/test environments or approval workflows for high-cost services prevent waste before it happens.

5. Multi-Cloud Visibility

Enterprises often juggle multiple providers. CostQ unifies AWS, Azure, and GCP data into a single dashboard, making it easy to compare costs and uncover cross-cloud savings opportunities.

How CostQ Enhances Cloud Financial Management

CostQ isn’t just a monitoring tool—it’s a decision-making platform.

- Unified Dashboards: Aggregate costs across cloud providers.

- AI-Powered Insights: Detect anomalies, idle resources, and savings opportunities.

- Predictive Analytics: Plan for future workloads with confidence.

- Real-Time Alerts: Stay ahead of overruns with proactive notifications.

- Collaboration Features: Enable CFOs, engineers, and product teams to work together.

Why Choose CostQ?

1. Purpose-Built for FinOps

Unlike generic cloud tools, CostQ is designed for financial operations in the cloud era.

2. Transparent Pricing

No hidden fees, no percentage-based charges. CostQ offers predictable pricing models.

3. Scalable Across Business Sizes

From startups to enterprises, CostQ adapts to any scale of cloud usage.

4. Expert-Led Support

CostQ brings FinOps expertise, offering not just software but also advisory support.

FAQs

Q1: What is cloud financial management, and how does CostQ help?

A: Cloud financial management is the practice of optimizing cloud costs and aligning spending with business goals. CostQ helps by offering visibility, forecasting, and governance in a unified platform.

Q2: How can CostQ reduce AWS costs by up to 50%?

A: By leveraging Reserved Instances, Spot Instances, anomaly detection, and right-sizing recommendations, CostQ helps businesses unlock 50% savings on AWS without performance trade-offs.

Q3: Who should lead cloud financial management initiatives?

A: Typically, a FinOps Lead or Cloud Cost Manager, working with finance, DevOps, and IT. CostQ provides the tooling and collaboration features to make this seamless.

Q4: What KPIs should organizations track in cloud financial management?

A: Common KPIs include cost per customer, savings from optimization, budget variance, and anomaly alerts. CostQ provides real-time dashboards to track these.

Q5: What’s the timeline for AWS savings with CostQ?

A: Businesses usually see immediate savings in the first month, short-term savings within 3–6 months, and long-term efficiency gains within 12–18 months.

Q6: Does CostQ support multi-cloud financial management?

A: Yes, CostQ integrates AWS, Azure, and GCP billing into one platform.

Q7: Can CostQ help enterprises during economic downturns?

A: Absolutely. CostQ ensures businesses can do more with less, making cloud costs sustainable during tight budgets.

Q8: Is CostQ only about cost-cutting?

A: No—CostQ focuses on strategic optimization, governance, and forecasting, not just expense reduction.

Q9: How secure is CostQ for financial data?

A: CostQ uses enterprise-grade encryption, compliance standards, and role-based access to keep financial data safe.

Q10: How does CostQ improve collaboration across finance and IT?

A: Through shared dashboards, real-time reporting, and team accountability, CostQ breaks down silos between finance and engineering.

External Authority Links

Conclusion

Cloud costs don’t have to be a black hole. With CostQ’s cloud financial management platform, businesses can transform chaos into clarity, waste into efficiency, and uncontrolled spend into predictable savings.

👉 Ready to take control of your cloud costs?

Book a Free CostQ Demo Today →

See how much you can save.